Building your credit score in the United States isn’t just a financial move—it’s a life move.

In 2025, whether you’re applying for a loan, renting an apartment, or even getting a job, a strong credit score can unlock countless doors. But for many, especially newcomers, students, or young professionals, that three-digit number is often a mystery.

This guide will walk you through simple, proven ways to build and boost your credit score fast in the USA—even if you’re starting from zero.

💡 What is a Credit Score, and Why Does It Matter?

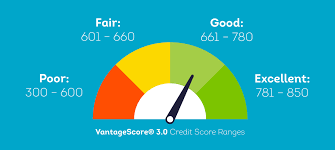

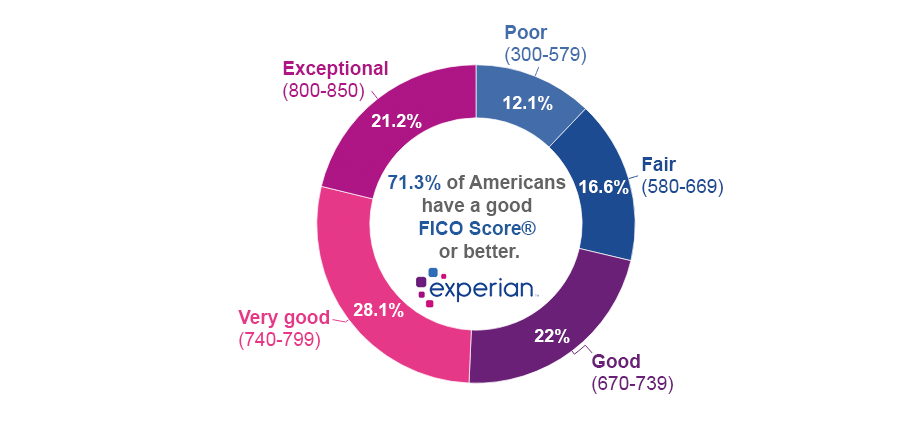

A credit score is a number (typically between 300 to 850) that lenders use to decide how risky you are to lend money to. It’s based on your credit history—your track record of borrowing and repaying money.

- Excellent: 750–850

- Good: 700–749

- Fair: 650–699

- Poor: Below 650

Higher score = lower interest rates, better loan approval, easier rental agreements, and even job opportunities.

🚀 1. Get a Secured Credit Card

If you’re new to credit, start with a secured credit card. You deposit money upfront (usually $200–$500), and that becomes your credit limit.

Top secured cards in 2025:

- Discover it® Secured Card

- Capital One Platinum Secured

- Chime Credit Builder Visa®

📝 Tip: Keep your utilization low—don’t use more than 30% of your limit.

📈 2. Become an Authorized User

Ask a parent, spouse, or friend to add you as an authorized user on their existing credit card. Their good payment history helps build your credit profile.

🔒 You don’t even need to use the card—just being listed helps!

🕐 3. Pay Every Bill On Time — Always

Payment history makes up 35% of your credit score.

- Set reminders or auto-pay for credit cards, loans, even utility bills.

- Late payments stay on your report for up to 7 years.

📌 Pro Tip: Paying even the minimum amount on time keeps your record clean.

💳 4. Use Credit — But Don’t Abuse It

Using credit cards wisely shows lenders you’re responsible.

- Use your card monthly, even for small purchases like gas or groceries.

- Keep utilization under 30%. For example, if your limit is $1,000, spend max $300.

High utilization = lower score.

🔄 5. Apply for a Credit-Builder Loan

Many online banks and credit unions offer credit-builder loans where you “borrow” money that’s held in a locked savings account. As you make payments, the lender reports your good behavior to credit bureaus.

Best credit-builder loan providers in 2025:

- Self Financial

- SeedFi

- Credit Strong

📊 6. Monitor Your Credit Report Monthly

Get your free credit report at AnnualCreditReport.com (official site).

- Check for errors or fraud.

- Dispute any incorrect info immediately.

Use tools like:

- Credit Karma (free)

- Experian

- MyFICO

🧼 7. Don’t Close Old Accounts (Unless You Must)

The longer your credit history, the better your score.

Even if you’re not using an old card, keep it open unless it charges high fees. Closing it shortens your history and can lower your score.

🚫 Bonus: Avoid These Mistakes

- Applying for too many cards in a short time → hard inquiries hurt your score

- Maxing out your cards

- Ignoring missed payments

- Using payday loans (they don’t help credit)

🎯 How Long Does It Take to Build Credit?

- From no credit to 650–700: 3 to 6 months (with discipline)

- To reach 750+: 1–2 years of consistent habits

The earlier you start, the better.

💬 Final Thoughts

Building credit fast in the USA isn’t about tricking the system — it’s about playing smart, safe, and consistent.

In 2025, with tools like secured cards, builder loans, and credit apps, anyone can go from zero to solid credit — whether you’re a student, a new immigrant, or just starting over.

Start now, stay disciplined, and watch those numbers rise!